The case for Rural Fiber

We recently worked on two separate projects to rollout fiber to the home to residential customers in challenging low-density rural areas in the US and in the UK. What is attracting investors to those segments, previously thought to be too marginal?

Data traffic is expected to grow by around 20 percent annually over the next five years (Ericsson 2022) and Fiber is the only fixed broadband technology able to deliver the symmetrical up/down speed and capacity required by customers. Several factors have also encouraged families to move to rural areas: House prices, better quality of life and the expectancy for reliable high-speed broadband.

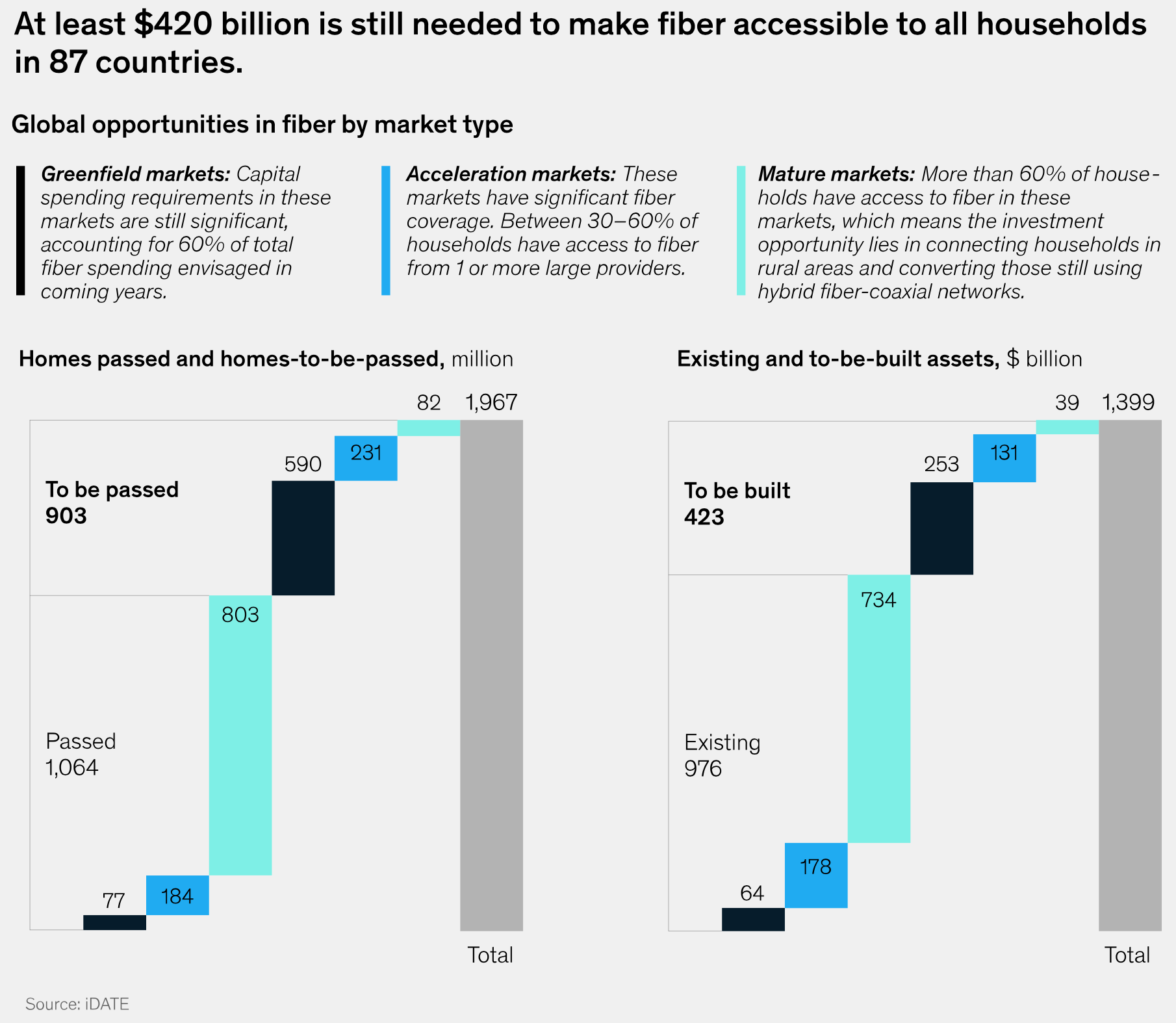

In the US alone, there are millions of households that still do not have a fiber connection, and there are also investment opportunities from fiberthat’s already laid.

In addition to organic growth of FTTH, there are a number of attractive strategies for rural fiber investors:

JVs with existing operators to deploy more fiber in lower-density areas.

Acquiring struggling fiber providers to improve and expand their existing operations.

Consolidating smaller fiber operators.

Acquiring an integrated operator and separating the network from the retail operation