Our client, a leading mid-mile fiber B2B provider in Kentucky and Georgia, wanted to extend their service to residential customers in rural locations passed by their network. The challenges were clear: The company did not have a residential consumer-facing capability in sales, marketing and support. On the network side, the company’s mid-mile fiber network did not extend to “last-mile” customer premises with the exception of a few enterprise customers. How would this scale up to extend last-mile fiber and equipment to tens of thousands of residential premises in low to mid-density suburban or rural setting?

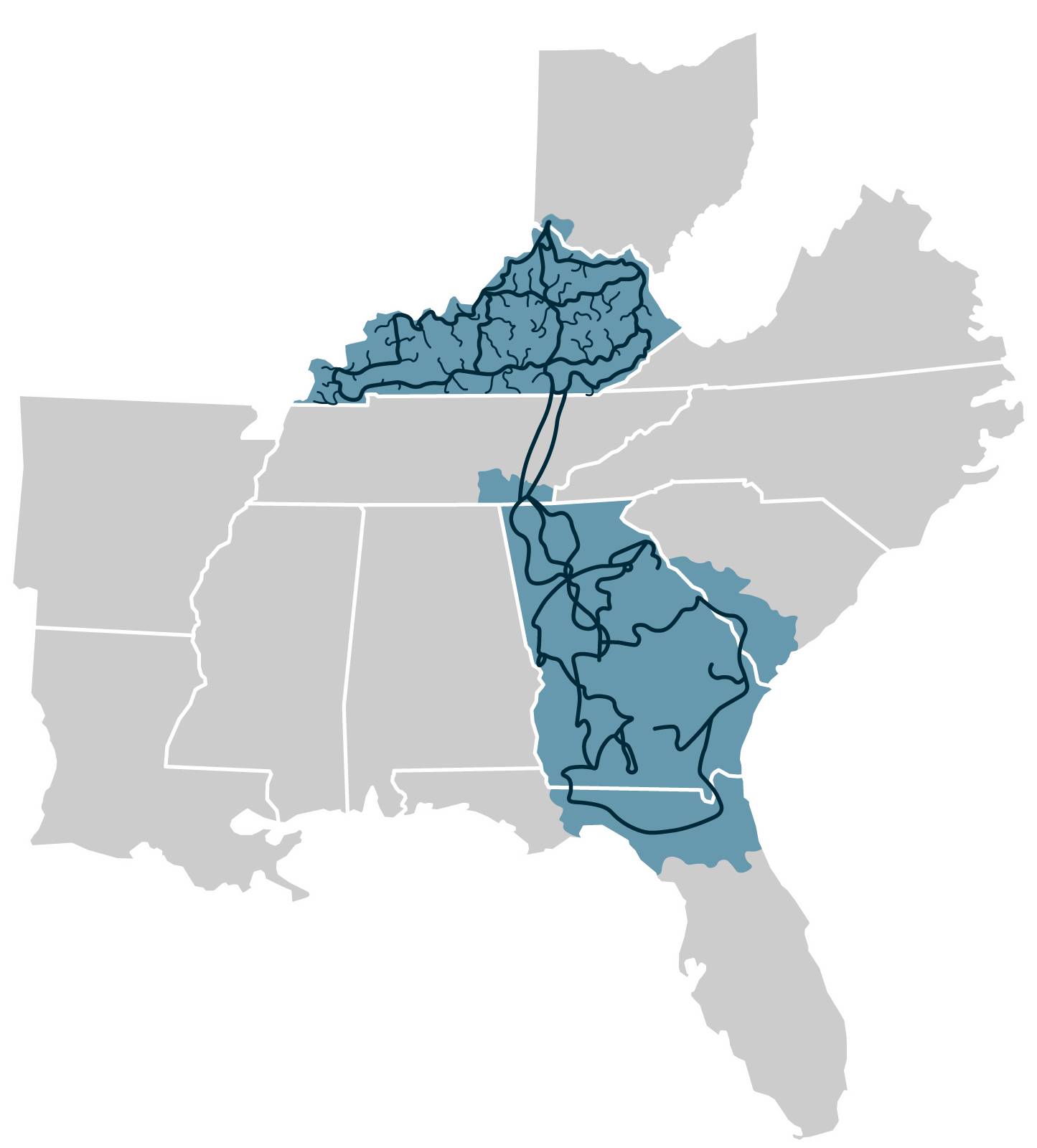

First, we surveyed the entire network coverage in GA and KY to locate and analyse passed cities and towns with sufficient population and housing densities that did not already have fiber coverage. Then we selected half a dozen representative towns in both states to perform a complete planning per town. The city of Ashland KY is shown in this example.

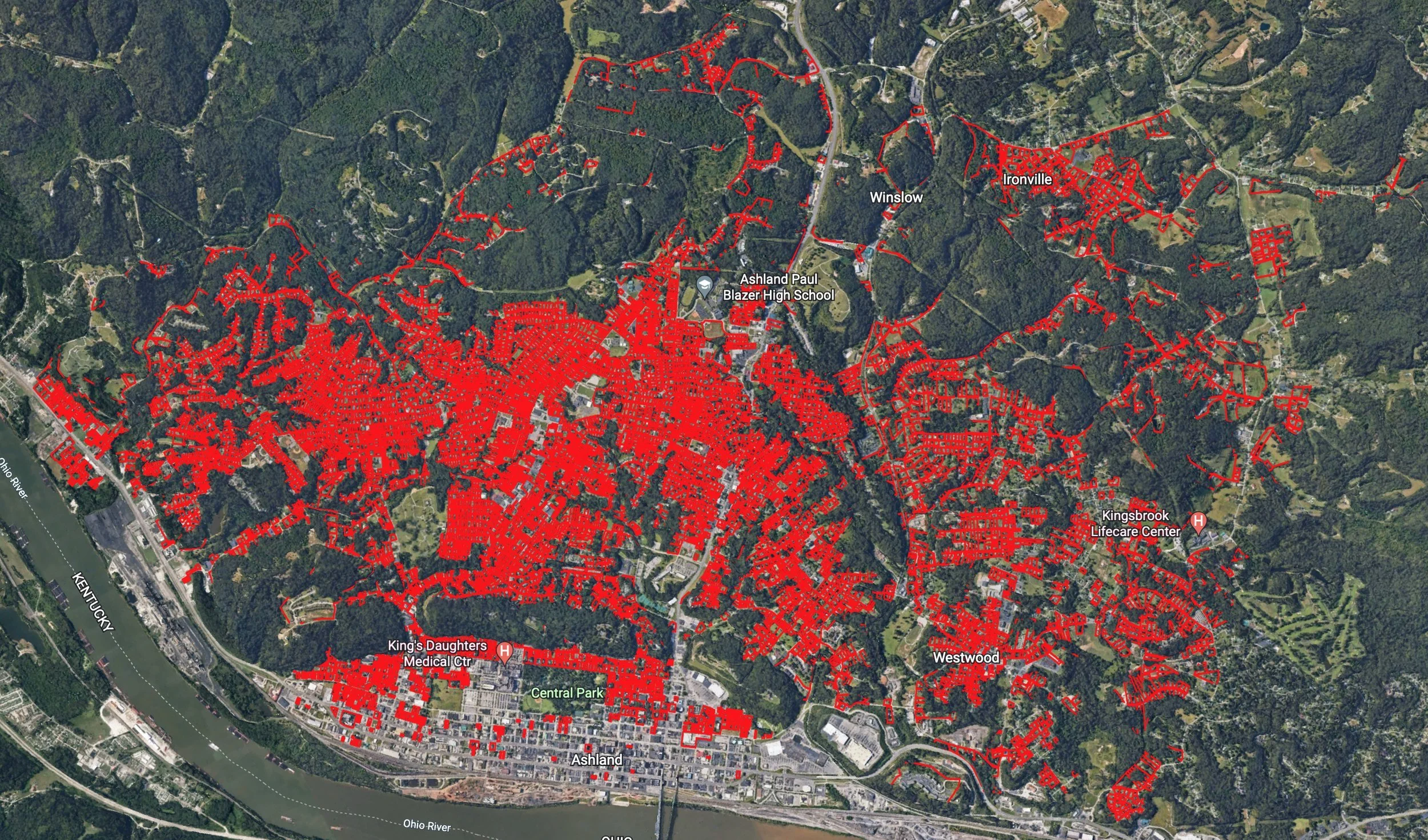

We used our GIS mapping tools to determine the exact location of every residential household in the city and its sprawling suburbs. Seen here as a red overlay.

We ran multiple iterations using our proprietary algorithms in order to arrive at the best network configurations which minimised the total length of fiber required, as well as outside plant and equipment.

The optimal location for each active and passive cabinet, distribution route, drop cables was performed for each of the ten thousand residential homes across Ashland.

We obtained competitive pricing from five equipment vendors for all the network equipment, including outside plant, connectorised or spliced fiber, and customer premises gateways and WiFi-6. We also obtained competitive pricing from OSP contractors for fiber overlashing on utility poles. In other projects with higher housing densities or where aerial fiber over-lashing was not possible, we have also planned for fiber ducting. We are experts at running aerial vs buried payback analysis.

While progressing network and equipment designs for several locations across KY and GA, our IT and commercial team was busy completing a gap analysis for the company’s IT systems, customer acquisition tools and processes. Several new capabilities were required to transform the business from a B2B mid-mile wholesaler into a customer-facing residential FTTH provider. We specified streamlined operational tools and processes including field resource management, billing and customer Support.

We completed a competitive analysis for each location, showing existing broadband providers including Cable or xDSL price-points, promotions and likely retail price evolution. A resource plan was developed including sales and marketing FTEs and IT support teams.

We also assessed the pros and cons of a direct to consumer approach versus partnering with established regional or national Internet service providers (ISPs) who would perform last-mile customer facing functions such as home gateway installations.

Key criteria in that analysis included the wholesale margin share with ISPs, as well as their ability to commit to minimum premises-passed conversion percentages. As part of that phase we directly approached five ISPs including two national and three regional and started detailed discussions on responsibilities, demarcation points as well as likely revenue and margin share.

The entire Network and Commercial process was repeated for half a dozen towns and cities in GA and KY and we compiled the results in a comprehensive business plan that provided all the investment decision metrics: Impact of Low, Medium and High prem-passed conversion rates, impact of percent penetration of residential households in a particular city and additional cost of reaching “outlier” homes. The commercial impacts of direct to consumer vs wholesale through ISPs were modelled and all the results aggregated into a comprehensive actionable investment plan including overall Capex and Open, Cashflow and Payback periods.